In today’s fast-paced world, managing your money efficiently is key. Many people use ATMs for quick deposits. However, sometimes adjustments are needed. This article explores EF ATM deposits and the adjustments that can occur. Resources like Creative Biz Services offer valuable insights on saving money and handling financial matters.

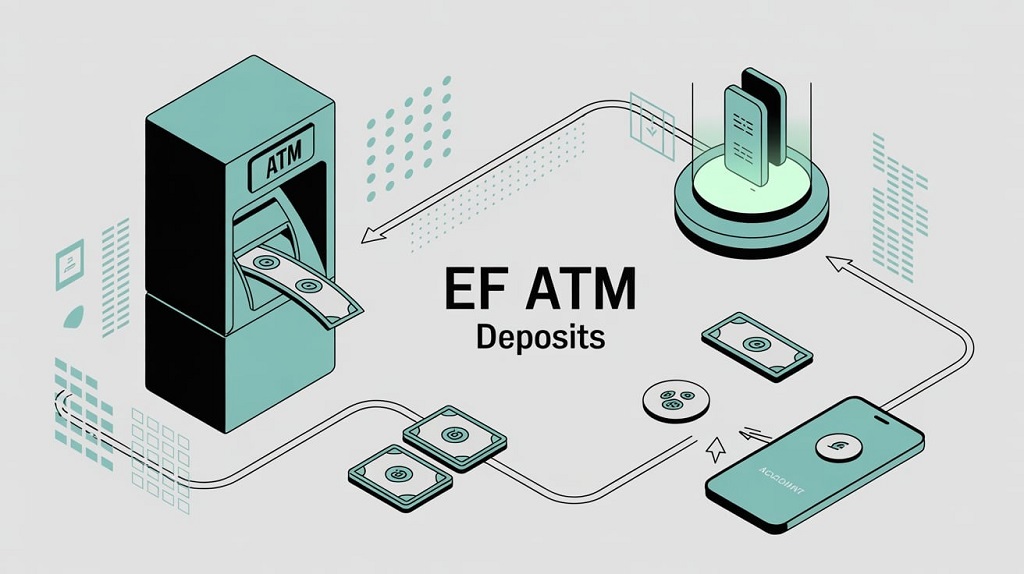

EF ATM deposits make banking easier. You can add funds to your account without visiting a branch. These deposits use electronic methods. Therefore, they process faster than traditional ways. But what happens when something goes wrong? That’s where adjustments come in.

An adjustment to ef atm deposit corrects errors in the process. For example, the amount might not match what you put in. Banks review the transaction. Then, they make changes if needed. This ensures your account reflects the right balance. Additionally, understanding this can save you time and stress.

What Are EF ATM Deposits?

EF stands for Envelope-Free or Electronic Funds. These deposits let you add cash or checks at an ATM without an envelope. The machine scans your items right away. As a result, funds often appear in your account quickly.

Many banks offer this service. It saves time for busy people. You insert your card, choose deposit, and follow the steps. The ATM counts the money or reads the check. Then, it gives you a receipt. However, not all ATMs support EF deposits. Check your bank’s app or website first.

This method is secure. Banks use encryption to protect your data. Plus, it’s convenient for after-hours banking. Therefore, more customers prefer it over waiting in line at a teller.

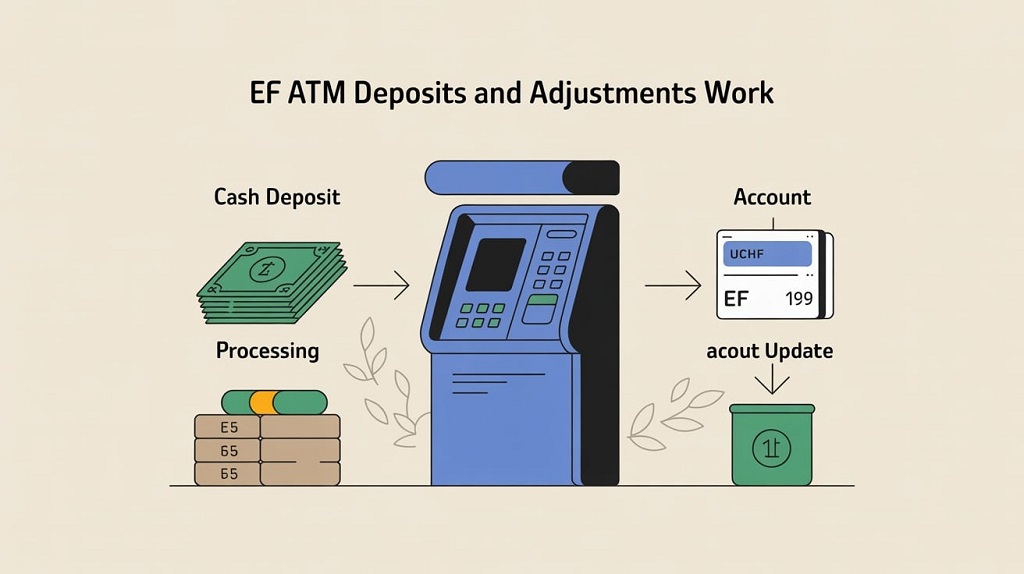

How Do EF ATM Deposits Work?

The process starts with finding a compatible ATM. Insert your debit card and enter your PIN. Select the deposit option. Next, feed the cash or checks into the slot. The machine verifies the amount.

Once done, confirm the total on the screen. If it’s correct, approve it. The ATM prints a receipt with details. Funds usually post within hours. But sometimes, it takes a day or two.

Banks process these electronically. Data goes straight to their system. This reduces errors from manual handling. However, machines can have issues. That’s why adjustments exist.

Understanding Adjustments in EF ATM Deposits

Adjustments fix problems after a deposit. For instance, the ATM might miscount bills. Or a check could be unreadable. The bank spots this during review. Then, they adjust your account.

These changes show up on your statement. You might see a credit or debit. Notifications come via email or app. Therefore, check your account often.

Adjustments are common but not frequent. Banks aim for accuracy. Yet, technology isn’t perfect. Human errors, like wrinkled bills, can cause issues too.

Common Reasons for Adjustments

Several factors lead to adjustments. Technical glitches top the list. An ATM might fail to read a deposit correctly. Dust or wear can affect sensors.

Deposit discrepancies happen too. You think you deposited $100, but it’s $90. The machine records what it sees. Later, the bank verifies and adjusts.

System delays play a role. Data transmission can lag. This holds up processing. As a result, funds appear late, needing adjustment.

Account problems contribute. If your account has holds or limits, deposits might adjust. For example, overdraft fees could offset the amount.

ATM malfunctions are another cause. If the machine is out of service soon after, deposits might not process right. Banks investigate these cases.

How to Handle an Adjustment

First, review your bank statement. Look for the adjustment entry. Note the date and amount. This helps understand the change.

Contact customer service next. Call or chat online. Explain the issue clearly. Provide your receipt and details. They can clarify what happened.

Document everything. Save emails, notes, and screenshots. If needed, escalate to a supervisor. Persistence pays off.

Follow up regularly. Adjustments take 1-3 business days usually. But complex cases last longer. Stay patient yet proactive.

If the adjustment causes loss, ask about refunds. Banks often correct errors at no cost. However, know your rights under banking laws.

Tips to Prevent Adjustment Issues

Prevention is better than cure. Choose reliable ATMs. Look for ones from your bank. Avoid those in remote spots.

Check the machine before depositing. See if it’s clean and working. Test with a small amount first if unsure.

Prepare your deposit well. Smooth out bills. Endorse checks properly. Count everything twice.

Keep your receipt always. It proves your transaction. Snap a photo for backup.

Monitor your account daily. Use banking apps for alerts. Spot issues early.

Report faulty ATMs immediately. Call the number on the machine. This helps others too.

Benefits of EF ATM Deposits Despite Adjustments

EF deposits offer speed. You bank anytime, anywhere. No branch visits needed.

They reduce paper use. No envelopes mean eco-friendly banking.

Accuracy improves over time. Banks upgrade machines regularly.

Costs stay low. Many deposits are free. Adjustments rarely add fees.

Convenience wins out. For busy lives, it’s a game-changer.

Potential Drawbacks and How to Mitigate Them

Drawbacks include possible adjustments. Delays can frustrate. However, quick action resolves most.

Security risks exist. Use well-lit ATMs. Cover your PIN.

Not all items deposit easily. Large checks might need a teller.

To mitigate, learn your bank’s policies. Read terms for deposits.

Use multiple methods. Combine ATMs with mobile deposits.

Stay informed. Follow banking news for updates.

The Role of Technology in EF Deposits

Technology drives EF deposits. Scanners read cash and checks fast.

AI helps detect errors early. This cuts adjustments.

Mobile integration links ATMs to apps. See deposits in real time.

Future tech promises more. Biometrics could replace cards.

However, tech evolves. Stay updated on changes.

Read More Also: Celebrity Fashion and Style Choices

Conclusion

EF ATM deposits simplify banking. They offer quick, easy fund additions. Adjustments correct rare errors, ensuring accuracy. By understanding reasons and handling tips, you minimize issues. Check statements, contact banks, and prevent problems. Overall, the benefits outweigh drawbacks. Embrace this modern method for better financial management.

Read More Also: Tire Pressure Monitoring System Hacks and Calibration

Frequently Asked Questions

What does EF stand for in ATM deposits?

EF often means Envelope-Free. It allows deposits without envelopes at compatible ATMs.

How long do adjustments take to process?

Most adjustments resolve in 1-3 business days. Complex cases may take longer.

Can I prevent adjustments entirely?

While not always, using reliable ATMs and preparing deposits carefully helps a lot.

What if an adjustment affects my balance negatively?

Contact your bank immediately. Provide proof, and they can investigate and correct it.

Are there fees for EF ATM deposit adjustments?

Usually not, if it’s a bank error. Check your account terms for details.